INTRODUCTION TO TAX CONSULTANCY VP&PARTNERS

Main Content:

1. What is tax consultancy?

2. Benefits for businesses using tax consultancy services

3. Important criteria when choosing a tax consultant

4. Why choose VP&Partners Tax Consultancy?

***1. What is tax consultancy?

With the continuous changes in the business environment in modern times, tax regulations are also constantly being updated each year to align with the government's economic and social development strategies. However, these changes have made it challenging for many businesses, including large organizations with a strong compliance mindset, to keep up with regulations. This situation leads to risks of tax reassessment, administrative penalties, and late payment fines during tax audits, etc. Therefore, tax consultancy is one of the essential services that businesses need. With tax consultancy services, companies will receive assistance to accurately understand the types and amounts of taxes they need to pay.

Tax consultancy services also help answer all questions businesses may have during their operations or regarding legal procedures when filing taxes.

***2. Benefits for businesses using tax consultancy services

-

Helps businesses stay updated on tax law changes

Currently, due to the constantly changing business environment, tax policies are also being continuously updated. Additionally, the level of integration and connectivity among tax management processes is low because there is no comprehensive model to redesign business processes. The tax system is complex, with many exemptions, reductions, and various tax types having to fulfill multiple functions and objectives. These issues make it difficult for businesses to keep track of information for accurate compliance.

With support from tax consultancy services, businesses will receive complete updates on tax policy information, enabling them to fulfill their tax obligations correctly and fully.

Although businesses may understand tax policies, accountants can still make mistakes during tax filings. A small error in the tax filing process can lead to significant complications and negative impacts on the business. Therefore, businesses need tax consultancy services to assist them during the tax filing process, helping them avoid risks related to errors and misunderstandings in tax declarations.

Tax consultants, with their in-depth knowledge and years of experience in the field, will help find optimal solutions for the issues businesses face. Companies will have peace of mind regarding compliance when receiving expert advice to identify potential risks and opportunities for tax savings.

- Helps businesses reduce costs

Instead of hiring and training staff, businesses using tax consultancy services will significantly reduce related costs. Additionally, the effectiveness of tax work will be much higher when conducted by a team of professional, experienced tax consultants.

***3. Important criteria when choosing a tax consultant

Taxes are a crucial issue for the operations of every organization, so choosing a reputable tax consultant is one of the key factors contributing to a business's success. Here are the criteria for selecting a tax consultant:

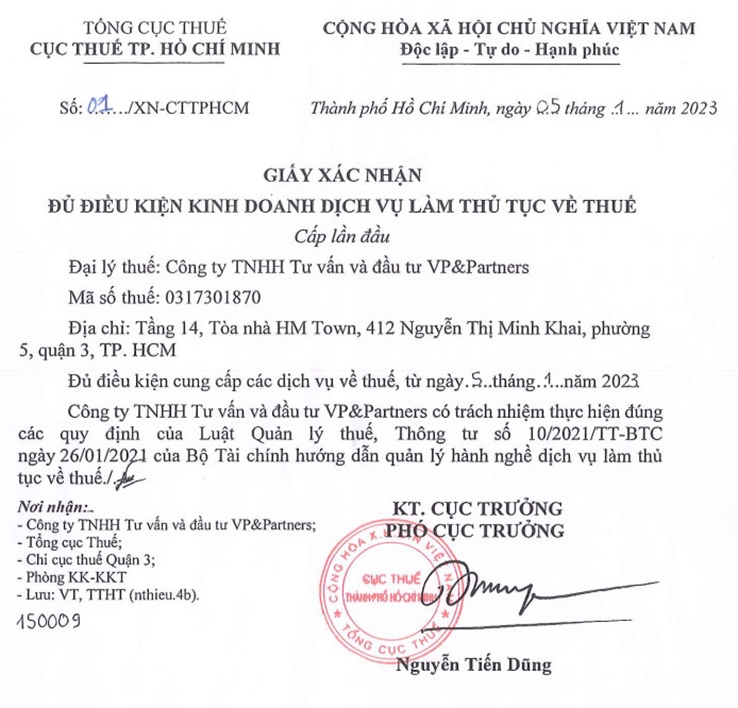

- The tax consultant is certified by the tax authorities as meeting the legal requirements to operate.

To verify the legitimacy of a tax agent, readers can check on the homepage of the General Department of Taxation here:

https://www.gdt.gov.vn/wps/portal/Home/dlt/dlt/!ut/p/z1/jZDLDoJADEW_hi2tQhDcIVEeITw0BJyNAUUggYEMA98vUZeINOmiN-f2pgUCCRCajlWR8qqlaT3NV6LcHF07Wgd56_rR2cDQ806o2BfEACF-A4apW_LORVRlE9GWD75nGeEGbQnIGj_-KB3X-RcAsrw-BrIYoUlfYOnEfyEOkKJus88_dZpJagGE5c-c5Uwc2CSXnHd7AQXkLL0PA6VcLB5Tt6M4UgHnfGXbc0jmeOiaKEqwCppY7V-c22C3/dz/d5/L2dBISEvZ0FBIS9nQSEh/

- The tax consultant can provide a variety of tax services

A professional tax consultancy firm is capable of offering services in various areas. Tax consultancy is not limited to just corporate income tax and value-added tax services. There are many other tax consultancy services that businesses may need during their operations, such as transfer pricing consultancy, personal income tax services, and global personnel services, among others.

- The tax consultant understands the client

A consultancy firm that strives to understand its clients is a trustworthy partner for businesses. The consultant should be ready to accompany the client to gain a deeper understanding of all aspects of their operations, providing comprehensive analyses of the market and legal landscape to help the business identify potential opportunities and challenges. Only with an understanding of the client's goals and success metrics can the tax consultant empower the client to maximize their potential.

***4. Why choose VP&Partners Tax Consultancy?

VP&Partners consistently strives to provide all clients with services that exceed their expectations. With extensive knowledge and expertise combined with a deep understanding of local contexts, we empower our clients to confidently move towards the future. We believe that every client deserves dedicated support based on the extensive knowledge and industry insights of the experts at VP&Partners. Whether the client is a small and medium-sized enterprise or a corporation, you can always rely on the latest knowledge and insights from our industry-leading experts. We take pride in sharing our expertise with clients in the most timely and efficient manner to help them overcome any challenges.

Our tax consultancy services include:

- Regular tax consultancy services (monthly);

- Tax compliance review and consultancy services (every 6 months and annually);

- Project-based tax consultancy services.

Please contact us for tax consultancy from top experts and professional services based on the Strength of Understanding.